The Jebel Ali Free Zone in Dubai is considered one of the most important global investment areas, and it is particularly suitable for foreign investment projects in the Emirates, as it is home to more than one country. Jebel Ali Port, which is close to the free zone, provides a suitable climate to facilitate trade and investment activities.

Jebel Ali Port is located in a strategic location in the city of Dubai in the United Arab Emirates, in an intermediate region between the Arabian Gulf, the Indian subcontinent and Africa. This strategic location has increased investors’ benefit from working in this region that attracts global trade, economic and financial projects, in addition to the industrial sector. Tourism is growing dramatically in that city, making millions of visitors flock annually not only for tourism but also to seize investment opportunities, especially in the Jebel Ali Free Zone.

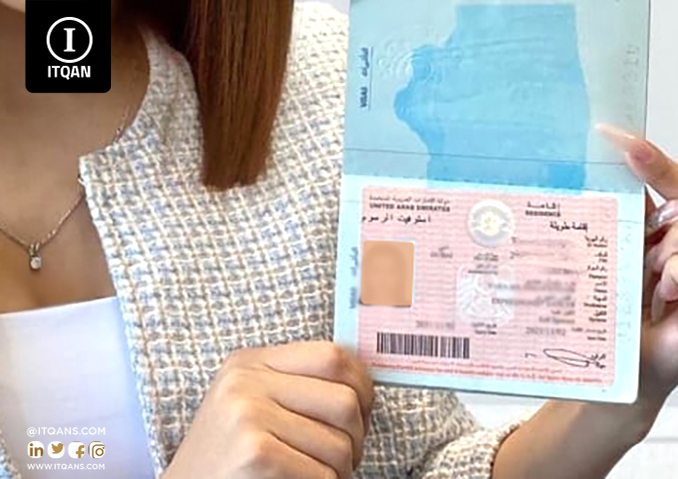

If you wish to establish a company in one of the free zones in Dubai , including the Jebel Ali Free Zone, you can obtain a partner or investor visa. This visa will allow you to stay in the United Arab Emirates for three years, renewable, to ensure the continuity of your business. But if he continues to stay outside the UAE for more than 6 months, this visa expires automatically.

Today, Dubai is considered one of the most suitable cities in the world for establishing companies and making various investments, thanks to the stable economic and political climate in the United Arab Emirates, in addition to the unprecedented support provided by the Dubai government in order to facilitate the establishment of companies and start doing business easily and conveniently.

جدول المحتوى

ToggleBenefits of establishing a business in the free zone

Establishing a business in the free zone is a smart and beneficial investment step for many entrepreneurs. Free zones provide an ideal environment for growth and prosperity for startups and medium-sized companies, thanks to flexible legislation and financial and logistical advantages that make it easier for companies to achieve success and expand. We will explore the benefits of setting up a business in a free zone :

Tax exemptions: Free zones are considered special tax zones, providing significant reductions or complete exemptions from taxes on profits, which provides an opportunity to achieve greater income for companies.

Customs facilities: Free zones offer easy and affordable customs procedures, which facilitates import and export operations and reduces administrative and time costs.

Ease of administrative procedures: Entrepreneurs in free zones enjoy simple and smooth administrative procedures, such as incorporation and licensing processes, which saves time and effort.

Access to regional and global markets: Thanks to the advanced infrastructure and distinctive geographical location, free zones allow companies to easily access local, regional and global markets, which increases opportunities for growth and expansion.

Flexible legislation: Free zones enjoy flexible legislation and flexibility in dealing, which allows companies to create a work environment that is appropriate and responsive to their needs.

Advanced infrastructure: Free zones provide advanced infrastructure that includes airports, ports, roads and communications, which supports transportation and distribution operations and facilitates shipping and supply operations.

Innovation, Research and Development: Free zones promote innovation, research and development by providing an encouraging and supportive environment for technical and innovative companies.

Investing in the free zone in the Emirates

Investing in the free zone in the Emirates

The free zones in the Emirates are considered one of the most important investment centers in the region, as they provide an ideal environment for companies and investors seeking to achieve success and prosperity in their businesses. Thanks to flexible legislation and advanced economic and logistical facilities, free zones represent an attractive investment opportunity for many economic sectors. Here are the benefits of investing in free zones in the Emirates:

Customs and tax facilities: Free zones in the UAE provide a complete exemption or significant reduction in customs duties and taxes, which helps reduce costs and increase profitability for companies.

Advanced infrastructure: Free zones have advanced infrastructure that includes ports, airports, roads and communications, which facilitates transportation and distribution operations and supports international trade.

Access to regional and global markets: Thanks to the strategic location of the UAE, companies in free zones can easily access regional and global markets, providing great opportunities for expansion and growth.

Encouraging business environment: Free zones provide an encouraging and supportive business environment for entrepreneurship and innovation, which encourages the establishment of startup companies and the development of innovative ideas.

Flexible legislation: Free zones are characterized by flexible legislation and flexibility in dealing, which facilitates establishment and operation procedures and reduces bureaucracy.

Focus on strategic sectors: The UAE seeks to develop strategic sectors such as technology, innovation and tourism, which provides promising investment opportunities in free zones.

Facilities granted by Jebel Ali Investment Zone

The Jebel Ali area in Dubai is one of the main industrial and logistics areas in the United Arab Emirates, providing an ideal environment for investment and encouraging companies to establish their operations there. The Jebel Ali region offers many facilities to investors, including flexible legislation, advanced infrastructure, and superior logistical facilities. Here are the facilities provided by Jebel Ali Investment Zone

Flexible and supportive legislation: The Jebel Ali region provides flexible and supportive legislation for companies, which facilitates establishment and operation procedures and reduces bureaucracy.

Tax Exemptions: Jebel Ali offers a complete exemption or significant reduction in taxes, which helps reduce costs and increase profitability for companies.

Customs Facilities: The Jebel Ali region provides affordable customs facilities, facilitating import and export operations and increasing logistics efficiency.

Advanced Infrastructure: The Jebel Ali region has a developed infrastructure that includes ports, airports, roads and communications, which facilitates transportation and distribution operations and supports international trade.

Focus on strategic sectors: The Jebel Ali region seeks to develop strategic sectors such as logistics, manufacturing and technology, which provides promising investment opportunities for companies.

Integrated industrial environment: Jebel Ali provides an integrated industrial environment that includes a diverse group of companies and industries, which facilitates cooperation processes and business partnerships.

Government support: The Jebel Ali region enjoys great support from the government, which is striving to develop infrastructure and improve the investment environment to attract more companies and investments.

Advantages of the Jebel Ali Free Zone in Dubai

Jebel Ali district in Dubai is one of the most prominent free zones in the United Arab Emirates, providing an ideal investment environment for companies and investors. Thanks to its strategic location and the economic and logistical facilities it provides, the Jebel Ali region attracts many national and international companies to establish and expand their business. Here are the advantages of the Jebel Ali Free Zone in Dubai:

Customs facilities: The Jebel Ali region provides great customs facilities, including exemptions and reductions in customs duties, which facilitates import and export operations and reduces logistical costs.

Advanced Infrastructure: The Jebel Ali region has a developed infrastructure that includes ports, airports, roads and communications, which facilitates transportation and distribution operations and enhances international logistics.

Tax exemptions: Jebel Ali offers a complete exemption or significant reduction in taxes on profits, making it an attractive destination for companies seeking to achieve high profitability.

Flexible legislation: The Jebel Ali region has flexible and supportive legislation for companies, which facilitates establishment and operation procedures and reduces bureaucracy.

Access to the regional and global market: Thanks to its strategic location, companies in the Jebel Ali region can easily access the regional and global market, providing great opportunities for expansion and growth.

Encouraging business environment: Jebel Ali provides an encouraging business environment that supports leadership and innovation, which encourages the development of startups and achieving success in local and international markets.

In conclusion, in cooperation with Itqan Company, investors and entrepreneurs can make the most of the investment opportunities in the Jebel Ali area of Dubai. Itqan Company provides comprehensive logistical and advisory support, by providing integrated services that include facilitating the process of obtaining licenses and providing the necessary legal and financial consultations, in addition to providing logistical support to ensure the smoothness and ease of investment and operation processes in the free zone.

Thanks to the effective cooperation with Itqan Company, investors can benefit from all the advantages of the Jebel Ali Free Zone in Dubai, and achieve sustainable success and strong economic growth. Hence, it is clear that moving towards investment in the Jebel Ali area of Dubai, in cooperation with Itqan Company, represents a strategic and successful choice that opens new horizons for leadership and development in the world of business and investment.

Frequently asked questions about Jebel Ali Free Zone, Dubai

What is the Jebel Ali Free Zone in Dubai?

Jebel Ali Free Zone in Dubai is an economic zone that provides an ideal environment for investment, as it provides customs, tax and administrative facilities for companies.

What facilities does Jebel Ali Free Zone offer?

The Jebel Ali Free Zone offers customs and tax facilities, in addition to advanced infrastructure and flexible legislation that facilitates investment and operation processes.

Are there specific requirements for establishing a company in Jebel Ali Free Zone?

Yes, companies wishing to establish their businesses in the Jebel Ali Free Zone must comply with local laws and regulations, and obtain the necessary licenses from the relevant authorities.

What are the benefits of investing in Jebel Ali Free Zone?

The benefits of investing in the Jebel Ali Free Zone include tax reductions, customs facilities, advanced infrastructure, and flexible legislation that supports investment and expansion operations.

Can I access global markets through Jebel Ali Free Zone?

Yes, thanks to Jebel Ali’s strategic location and the available logistical facilities, companies in the free zone can easily access global markets and expand their business operations.

Are there costs or fees to establish a company in Jebel Ali Free Zone?

This varies depending on the type of company and its activity, but generally, there are registration and licensing fees applied to companies wishing to establish their business in the Jebel Ali Free Zone.